Sign up before May, 31, and enjoy our free Solo plan

- Business account opened online

- ATM withdrawal limit: € 500

- Free physical & virtual VISA cards

- Up to 5 free In / Out SEPA and Direct debit transfers

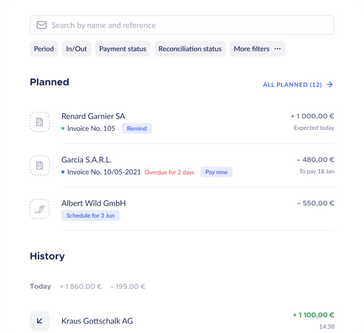

- State-of-the-art invoicing solution

All-in-one financial solution for Freelancers and SMEs

Account opened online in 24 hours

Spend anywhere and receive the highest cashback on the market

Expense management solution for team spending control

That gets you paid faster. Simple and powerful

Issue multiple free VISA debit cards with 0% commission

Optimize finances — transactions being automapped with invoices and receipts in accounting ready data

Be it receipt, invoice or any other important document — collect it in Finom secure storage in several clicks

Extract data from receipt or any other document with auto-recognition feature

Track and categorize expenses online. Control where you spend more and reduce costs month-by-month.

Auto integration of invoicing with Finom API in any e-store, CRM, or ERP

Function of uploading all documents and transactions

And what about you?!

From affordable plans for freelancers to tailored tariffs

designed specifically for teams ready to scale up. There’s a solution for you!

Enjoy 1 month free trial for other plans

Price

Users included

1

2

5

Cashback

0%

2%

3%

Access to Business Platform

Accounting integrations

All transactions history in smart dashboards

Real-time notifications

Multi-Companies

Number of connected banks and payment service provider

Mobile app (iOS & Android)

99% guaranteed uptime SLA

Role and user management

Accountant access

Manual access to wallets for team members

Visual analytics of income and expenses

Dark theme

Custom

from 99 €

Tailored for your business

Apply nowAll-in-one Business Platform

Users included

1

2

5

Cashback

0%

2%

3%

Access to Business Platform

Accounting integrations

All transactions history in smart dashboards

Real-time notifications

Multi-Companies

Number of connected banks and payment service provider

Mobile app (iOS & Android)

99% guaranteed uptime SLA

Role and user management

Accountant access

Manual access to wallets for team members

Visual analytics of income and expenses

Dark theme

Invoicing

Invoices (in/out)

Fast invoice payments by your customers

Invoices statuses tracking

Invoicing API access

QR codes for invoices

Invoice and receipt recognition

Manual reconciliation of invoices and receipts

Credit notes

Customization of invoice templates

Automatic collection of documents

Provided by Finom

Monthly fee for extra team member

4 €

2 €

1 €

Fee per recognized document

2 € after 8

1,5 € after 8

1 € after 8

Provided by Finom Payments

Physical VISA card issuance (up to 3 per user)

Physical VISA cards for business owners

0 €

0 €

0 €

Physical VISA cards for team members

0 €

0 €

0 €

Physical VISA card reissuance

0 €

0 €

0 €

Monthly fee for the inactive physical card

2 €

1 €

0 €

Virtual VISA card issuance (unlimited)

Virtual VISA cards for team members

0 €

0 €

0 €

Monthly fee for the inactive virtual card

1 €

0,5 €

0 €

Card payments in EUR (except for certain MCCs)

0 €

0 €

0 €

Card payment limit per card (per month)

100.000 €

100.000 €

100.000 €

Card payments in foreign currency (non-EUR)

3%

2%

1%

Card payments for certain MCCs (%, minimum 1 €)

€ 0 - € 500

1%

0%

0%

€ 500 - € 2,500

2%

1%

0%

€ 2,500 - € 5,000

3%

2%

1%

€ 5,000+

3%

3%

3%

Fee for ATM withdrawals

2 € for each withdrawal

2 € after 5 withdrawals

2 € after 10 withdrawals

Extension of ATM withdrawal limit up to € 10 000 (paid per month)

15 € after 500 €

10 € after 2.000 €

5 € after 5.000 €

Fee for ATM withdrawals in foreign currency (non-EUR)

3%

2%

1%

Monthly fee for extra wallet

4 € after 1 wallet

2 € after 2 wallets

1 € after 3 wallets

Fee for extra in/out SEPA transfers & Direct Debits

0,2 € after 5

0,2 € after 100

0,2 € after 200

Fee for extra SEPA OUT & Direct Debit transfers (per month)

0,1% after 25.000 €

0,1% after 50.000 €

0,1% after 100.000 €

Decline of Direct Debit

5 €

5 €

5 €

Fee for SEPA Instant transfers

€ 0 — € 500

1 €

1 €

1 €

€ 500 — € 2,000

3 €

3 €

3 €

€ 2,000+

5 €

5 €

5 €

Transfers between Finom's users in a few seconds

0 €

0 €

0 €

Outgoing international payments (fee per payment)

10 €

10 €

10 €

Incoming international payments (fee per payment)

0 €

*free until 14.06.2024

0 €

*free until 14.06.2024

0 €

*free until 14.06.2024

International payments monthly free volume

100.000 €

100.000 €

100.000 €

Fee for exceeding monthly free volume of international payments

2%

1%

1%

Outgoing payment investigation

Incoming payment investigation

Fee for providing MT103

Fee for MT199 request

Processing bulk payments

Scheduled payments

Repeat payment

Provided by Finom

Express delivery of Finom Card

30 €

30 €

30 €

Provided by Finom Payments

Recall of outgoing SEPA SCT

15 €

15 €

15 €

Inquiry on SEPA SCT (Payment Investigation)

15 €

15 €

15 €

Audit confirmation statement

100 €

100 €

100 €

Refusal to redeem an authorized direct debit due to insufficient account balance

1 €

1 €

1 €

Unarranged negative balance on Finom Business Account

1 € per day

1 € per day

1 € per day

Dunning letter (per letter)

5 €

5 €

5 €

Seizures and Garnishments applied to the Finom Business Account (per seizure/garnishment)

25 €

25 €

25 €

Please note that Finom does not provide any financial services. External payment providers will be used to provide you with regulated services

For our detailed price list, download PDF here

Payment Card Industry Data Security Standards compliant

Our servers are protected and hosted in the European Union

Data encryption prevents it from being stolen or intercepted

Confirm each online card transaction with a unique one-time password

24/7

Contact us on e-mail: [email protected]

Update your browser for enhanced security, speed and the best user experience on this site.